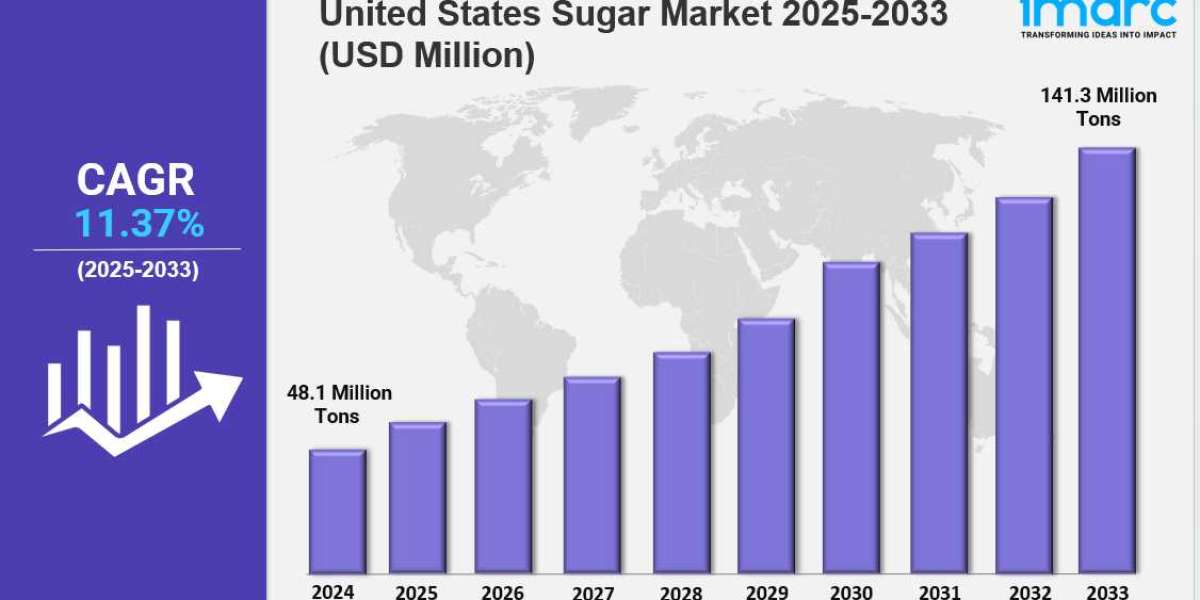

Market Overview 2025-2033

United States sugar market size reached 48.1 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 141.3 Million Tons by 2033, exhibiting a growth rate (CAGR) of 11.37% during 2025-2033. The U.S. market is expanding due to rising demand for convenient sweeteners, robust food and beverage production, and growth in industrial applications. Growth is driven by flavored and brown sugar trends, health-conscious product lines, and strong processing infrastructure, making it dynamic and competitive.

Key Market Highlights:

✔️ Steady market growth driven by sustained demand from food and beverage manufacturing sectors

✔️ Increasing focus on alternative and low-calorie sweeteners amid rising health awareness

✔️ Expanding domestic production supported by technological advancements in sugar processing and crop yields

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-sugar-market/requestsample

United States Sugar Market Trends and Drivers:

The United States sugar market is undergoing a major transformation driven by shifting consumer preferences, stricter regulations, and rising concerns about health and sustainability. Public health issues such as obesity, diabetes, and excessive sugar consumption are changing consumer buying behavior, pushing companies like Coca-Cola and PepsiCo to expand their zero-sugar and reformulated product lines—growing by over 40% in recent years.

Regulatory efforts, including the FDA’s added sugar labeling rules and soda taxes in several cities, continue to reduce traditional sugar use. Demand for alternatives such as stevia and monk fruit—now comprising around 18% of the market—reflects a growing preference for low- or no-calorie sweeteners. Although the pandemic briefly boosted sugar use due to increased home baking, the long-term trend points toward moderation and substitution.

Trade policy also plays a critical role in shaping the U.S. sugar market. The tariff-rate quota (TRQ) system keeps domestic prices high, benefiting local producers but increasing costs for food manufacturers. Reduced imports from Mexico—once the top sugar exporter to the U.S.—and Brazil’s focus on ethanol production, alongside climate disruptions in areas like Louisiana, have tightened supply and fueled calls for TRQ reform and supply chain diversification.

Sustainability is increasingly central to sugar market dynamics. Companies such as Florida Crystals are implementing regenerative agriculture practices, reducing carbon emissions by over 120,000 tons annually. Sugar beet farmers are adopting precision agriculture to improve water efficiency and reduce chemical use. Additionally, labor concerns are accelerating demand for Fair Trade-certified sugar, which now represents 18% of retail sales. Retailers are requiring suppliers to meet strict ESG standards, driving industry-wide operational shifts and consolidation.

Market concentration is intensifying, with the top five cooperatives controlling over 63% of beet processing and more than 70% of cane refining. Since 2020, over $2 billion has been invested in automation and infrastructure upgrades. Contract farming has become the dominant model, providing stability for processors while reducing the role of independent growers. Industrial buyers—primarily in beverage and confectionery—account for about 68% of sugar consumption, though annual growth has slowed to just 0.8% due to reformulations.

Health-focused niches, including organic and non-GMO sugar, are growing rapidly at a projected CAGR of 7.2%, reflecting consumer interest in clean-label products. Government support remains a key driver, with sugar subsidy programs worth an estimated $3.5 billion per year shaping Farm Bill discussions. Ethanol incentives continue to redirect sugarcane from food to fuel. Technology adoption is rising, with 40% of U.S. sugar mills now using blockchain and traceability tools to meet ESG disclosure needs.

Climate-related disruptions, such as the 2024 Panama Canal drought, have strained logistics and pushed spot prices up by over 20%. In response, gene-edited, drought-resistant sugar beet strains are entering early commercial use to support future production.

Overall, the U.S. sugar market outlook is shaped by a complex mix of health, sustainability, and policy factors. Companies that prioritize innovation, transparency, and adaptable sourcing will be best positioned to grow their market share. As both regulatory pressure and consumer expectations continue to rise, the future of the U.S. sugar industry hinges on its ability to meet diverse and evolving demands.

United States Sugar Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- White Sugar

- Brown Sugar

- Liquid Sugar

Breakup by Form:

- Granulated Sugar

- Powdered Sugar

- Syrup Sugar

Breakup by Source:

- Sugarcane

- Sugar Beet

Breakup by End User:

- Food and Beverages

- Pharma and Personal Care

- Household

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145